Starbucks has established itself as a global powerhouse in the coffee industry, renowned for its premium coffee, iconic stores, and strong brand identity. From a single coffee shop in Seattle to thousands of locations worldwide, Starbucks’ success is rooted in a well-crafted business model. This blog delves into Starbucks’ business model, focusing on its revenue streams, unique selling proposition (USP), SWOT analysis, and market valuation.

About Starbucks

Founded in 1971, Starbucks started as a small coffee shop in Seattle, selling high-quality coffee beans and equipment. Over the decades, the company evolved into a global coffeehouse chain, offering a range of beverages, food items, and merchandise. Starbucks is now synonymous with premium coffee and a luxurious coffeehouse experience, boasting a presence in over 80 countries with more than 35,000 stores.

Starbucks Business Model

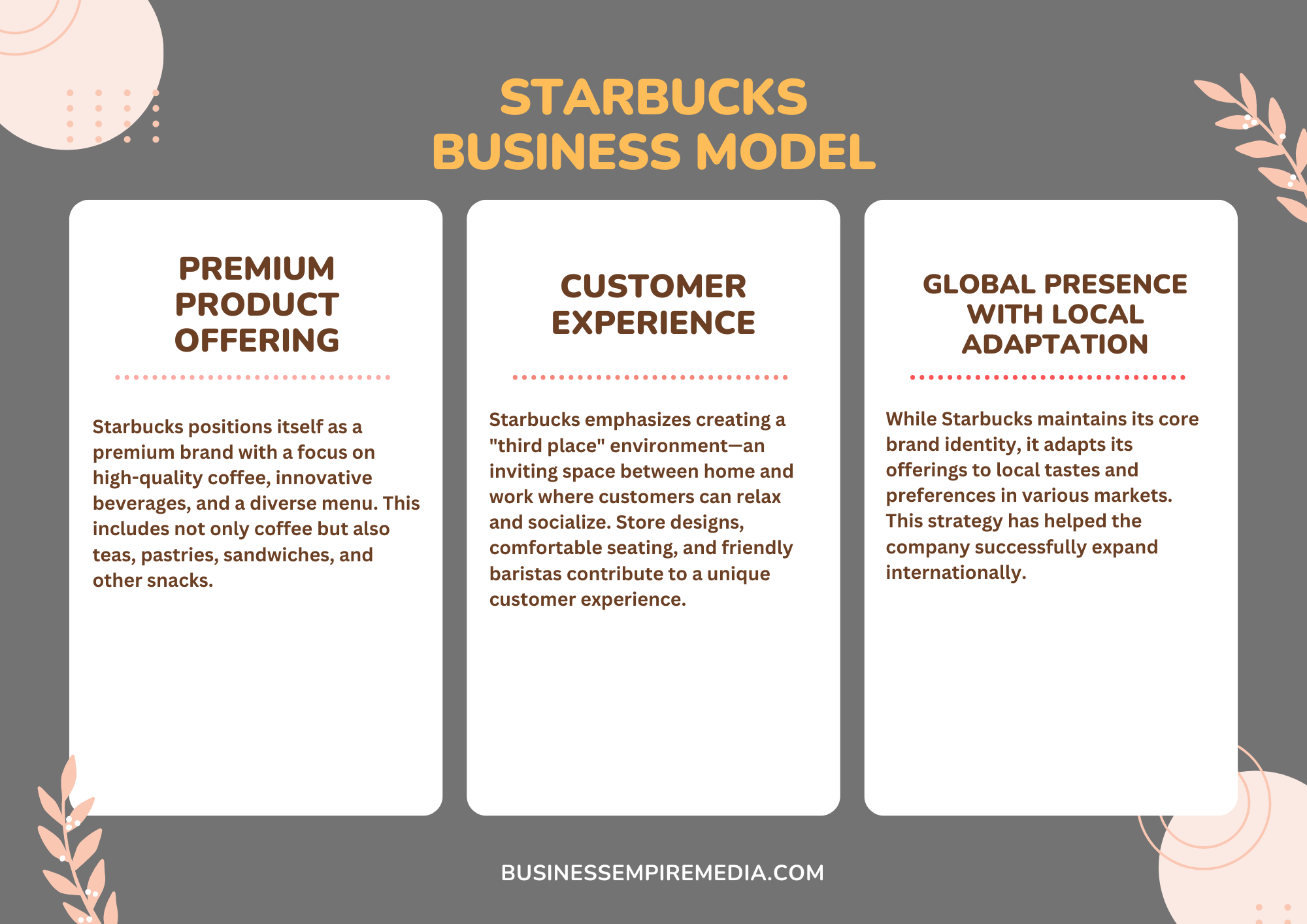

Starbucks’ business model revolves around creating a premium coffee experience that extends beyond just a cup of coffee. The company’s success can be attributed to several key components:

- Premium Product Offering: Starbucks positions itself as a premium brand with a focus on high-quality coffee, innovative beverages, and a diverse menu. This includes not only coffee but also teas, pastries, sandwiches, and other snacks.

- Customer Experience: Starbucks emphasizes creating a “third place” environment—an inviting space between home and work where customers can relax and socialize. Store designs, comfortable seating, and friendly baristas contribute to a unique customer experience.

- Global Presence with Local Adaptation: While Starbucks maintains its core brand identity, it adapts its offerings to local tastes and preferences in various markets. This strategy has helped the company successfully expand internationally.

Starbucks Revenue Streams

Starbucks generates revenue through a diversified model that includes several key streams:

- Company-Operated Stores: The largest portion of Starbucks’ revenue comes from its company-owned stores. These stores sell a variety of coffee beverages, teas, food items, and branded merchandise, contributing significantly to the company’s overall income.

- Licensed Stores: Starbucks licenses its brand to external operators, who run Starbucks-branded stores. The company earns revenue from these stores through licensing fees and a percentage of their sales, allowing Starbucks to expand its presence without directly managing every location.

- Consumer Packaged Goods (CPG): Starbucks sells packaged coffee beans, ready-to-drink beverages, and other coffee-related products in grocery stores, retail outlets, and online. This stream extends Starbucks’ reach beyond its physical stores, tapping into the home-brewing market.

- Foodservice Accounts: Starbucks supplies coffee and other products to hotels, restaurants, airlines, and other commercial entities. These foodservice partnerships provide an additional revenue stream by expanding Starbucks’ brand presence in non-store environments.

- Starbucks Rewards Program: The Starbucks Rewards loyalty program encourages repeat business by offering points (Stars) for purchases. Members can redeem these points for free items, which increases customer retention and indirectly boosts revenue through increased customer loyalty and spending.

Starbucks Unique Selling Proposition (USP)

Starbucks’ Unique Selling Proposition (USP) lies in its ability to offer more than just coffee—it provides a premium, personalized experience that distinguishes it from competitors. The key elements of Starbucks’ USP include:

- Premium Quality: Starbucks is renowned for its high-quality coffee, sourced ethically and roasted to perfection. The company’s commitment to quality extends to its wide range of beverages and food items, ensuring a consistently excellent product.

- Customer Experience: Starbucks creates a “third place” between home and work, offering a welcoming and comfortable environment where customers can relax, socialize, or work. This focus on ambiance and service enhances the overall customer experience.

- Customization and Innovation: Starbucks allows customers to personalize their drinks to suit individual tastes, offering a vast array of options. The company also continually innovates with new products and seasonal offerings, keeping the menu fresh and exciting.

- Strong Brand Identity: The Starbucks brand is globally recognized and associated with luxury, quality, and a unique coffeehouse experience. The iconic green logo, consistent store design, and brand storytelling contribute to strong brand loyalty and market differentiation.

SWOT Analysis of Starbucks

Strengths:

- Strong Brand Equity: Starbucks is a globally recognized brand with a loyal customer base, known for its premium coffee and distinctive customer experience.

- Global Presence: With over 35,000 stores in more than 80 countries, Starbucks has a vast international footprint, making it a leader in the coffee industry.

- Innovation: Starbucks continually innovates with new products, technology, and customer engagement strategies, enhancing its market position.

- Sustainability Initiatives: The company is committed to ethical sourcing and sustainability, appealing to socially-conscious consumers and enhancing brand reputation.

Weaknesses:

- High Pricing: Starbucks’ premium pricing strategy can limit its appeal to cost-conscious consumers, especially in price-sensitive markets.

- Dependence on the U.S. Market: A significant portion of Starbucks’ revenue comes from the U.S., making the company vulnerable to economic fluctuations in its home market.

- Menu Limitations: While Starbucks offers a variety of beverages, its food menu is less extensive compared to some competitors, potentially limiting customer options.

Opportunities:

- Expansion into Emerging Markets: There is significant growth potential in emerging markets, particularly in Asia and Africa, where coffee consumption is increasing.

- Product Diversification: Expanding the menu to include more health-conscious and plant-based options could attract a broader customer base.

- Digital and Delivery Services: Enhancing digital platforms, mobile ordering, and delivery services can improve convenience, capture more market share, and boost customer loyalty.

Threats:

- Intense Competition: Starbucks faces strong competition from global and local coffee chains, as well as from independent cafes and fast-food outlets.

- Economic Downturns: Economic slowdowns or recessions can impact discretionary spending, affecting sales of premium products like Starbucks coffee.

- Regulatory Challenges: Changing regulations related to food safety, labor laws, and environmental standards can pose operational challenges and increase costs.

This SWOT analysis highlights the strengths that have driven Starbucks’ success, while also identifying areas for potential growth and challenges that the company must navigate to maintain its market leadership.

Starbucks Financial Performance (Q2 Fiscal 2024)

For the second quarter of fiscal year 2024, Starbucks reported a challenging period marked by a 2% decline in consolidated net revenues, bringing total revenue down to $8.6 billion. This dip was largely influenced by a complex operating environment, including a 4% decline in global comparable store sales, with North America and the U.S. showing a 3% drop. Additionally, the company faced significant operational challenges, with GAAP operating margin contracting by 240 basis points to 12.8%, mainly due to increased costs in partner wages and benefits, and general and administrative expenses.

Despite these hurdles, Starbucks’ long-term strategy remains intact, with a focus on store expansion and innovation. The company added 364 net new stores during the quarter, bringing the total to 38,951 stores globally. Active membership in the Starbucks Rewards loyalty program grew by 6% year-over-year, reaching 32.8 million members in the U.S.

While the quarter did not meet expectations, Starbucks’ leadership expressed confidence in their strategic roadmap and long-term growth potential, with continued investment in their “Triple Shot Reinvention with Two Pumps” strategy to address current challenges and capitalize on future opportunities

Valuation of Starbucks (2024)

As of the latest available data in August 2024, Starbucks Corporation (SBUX) is valued at approximately $115 billion, reflecting its strong brand equity, global presence, and diverse revenue streams. The company’s stock has been performing well, with a current price of around $95.90 per share, indicating investor confidence despite recent operational challenges.

Starbucks’ valuation is supported by its consistent revenue generation from both company-operated and licensed stores, as well as its lucrative consumer packaged goods (CPG) segment. The company’s price-to-earnings (P/E) ratio stands at approximately 30, which is slightly higher than the industry average, showcasing the premium investors are willing to pay for its future growth potential.

In terms of enterprise value (EV), which includes the company’s market capitalization plus debt, minus cash and cash equivalents, Starbucks’ EV is estimated to be around $120 billion. This metric is critical for assessing the company’s overall valuation, particularly when considering its expansion plans and reinvestment strategies.

Starbucks’ valuation is also influenced by its strong cash flow generation, disciplined capital allocation, and commitment to returning value to shareholders through dividends and share repurchases. The company’s dividend yield is around 2%, offering an attractive return for income-focused investors.

Disclaimer

The information provided in this blog is for general informational purposes only and is based on publicly available data as of August 2024. While efforts have been made to ensure the accuracy and reliability of the data presented, the financial markets are dynamic, and the information provided may not reflect the most current developments. Readers are encouraged to conduct their own research and consult with financial professionals before making any investment decisions. The blog does not constitute financial advice, and the author is not responsible for any actions taken based on the information provided. The views expressed are those of the author and do not necessarily reflect the views of Starbucks Corporation or any other entity mentioned.