Options trading offers a versatile toolkit for investors, allowing them to capitalize on market movements, hedge against risk, and generate income. However, navigating the complexities of options requires a strategic approach.

Here are some of the best Option Trading Strategies

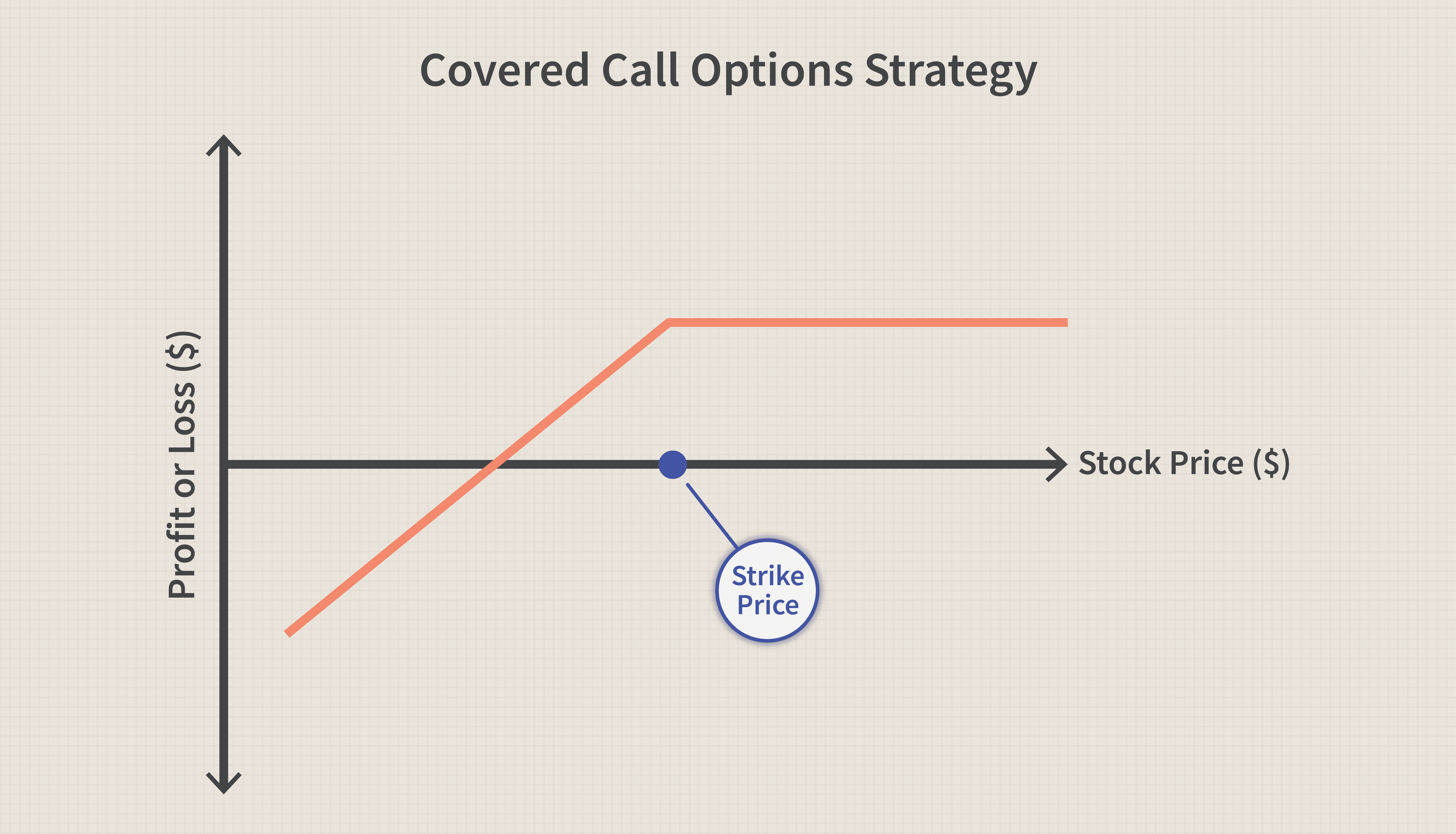

1. Covered Call Strategy

A Covered Call is an options trading strategy that involves holding a long position in a stock and selling a call option on the same stock. This approach allows investors to generate income from option premiums, which can be particularly attractive in flat or moderately bullish markets.

How to Use the Strategy

To implement a Covered Call, follow these steps:

- Own the underlying stock: You need to hold the shares of the stock on which you intend to sell the call options.

- Sell call options: Write call options on the stock at a specific strike price and expiration date. The premium received from selling the options is your income.

- Monitor the market: Monitor the stock’s price movement and the option’s expiration date to manage the position effectively.

Best Time to Use This Strategy

The best time to use a Covered Call strategy is when you expect the market to be relatively flat or mildly bullish. It’s ideal when you anticipate little to no significant movement in the stock’s price.

Advantages

- Income Generation: Earns income through premiums from selling call options.

- Downside Protection: Premiums can provide some protection against a decline in the stock’s price.

- Flexibility: You can set the strike price and expiration date based on your market outlook.

Disadvantages

- Limited Upside: Profit potential is capped at the call option’s strike price.

- Stock Assignment Risk: If the stock price exceeds the strike price, the stock may be called away.

- Management: Requires active monitoring and management of the position.

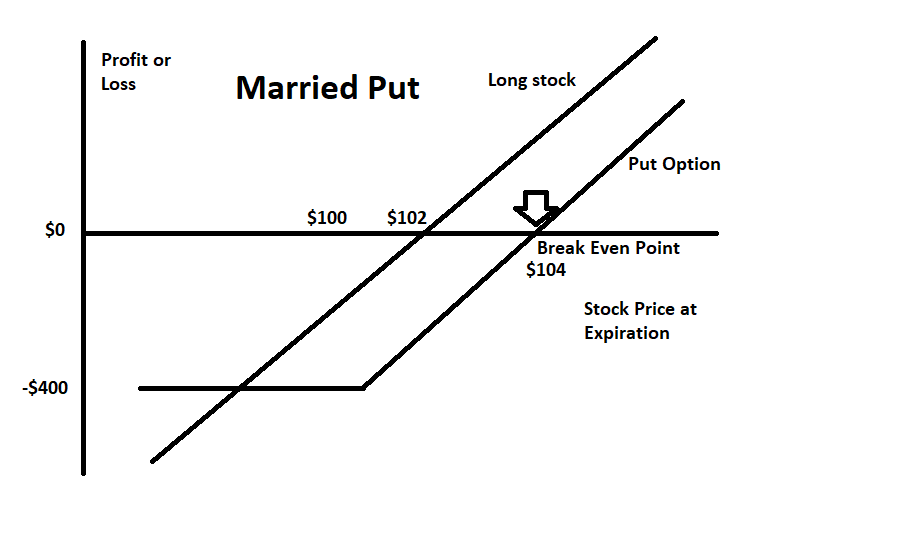

2. Married Put Strategy

The Married Put strategy is an options trading technique where an investor buys a put option for an equivalent number of shares they own in the underlying stock. This strategy acts as insurance, protecting the investor’s portfolio against a decline in the stock’s price.

How to Use the Strategy

To utilize a Married Put, you should:

- Own the stock: Hold shares in the stock for which you are buying the put options.

- Buy put options: Purchase at-the-money put options for the same number of shares you own.

- Set the expiration: Choose an expiration date that aligns with your forecast for potential stock volatility.

Best Time to Use This Strategy

The optimal time to employ a Married Put is when you are bullish on the stock’s long-term prospects but are concerned about potential short-term downside risks.

Advantages

- Downside Protection: Limits potential losses if the stock price falls.

- Stock Ownership Benefits: You continue to enjoy benefits like dividends and voting rights.

- Profit Potential: You can still profit from any stock price appreciation.

Disadvantages

- Cost: The premium paid for the put options can be significant.

- Limited Use: May not be cost-effective for frequent use or for long-term investors who are less concerned with short-term fluctuations

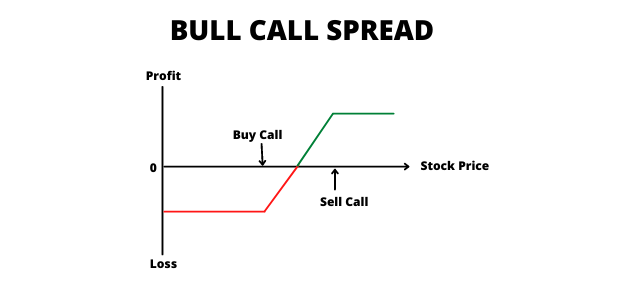

3. Bull Call Spread Strategy

The Bull Call Spread is an options trading strategy designed for investors who are moderately bullish on a stock or index. It involves buying a call option at a lower strike price and selling another call option at a higher strike price, with both options having the same expiration date.

How to Use the Strategy

To execute a Bull Call Spread, you should:

- Buy a lower strike call option: This is the option you are betting will increase in value.

- Sell a higher strike call option: This option is sold to offset the cost of the bought call, reducing the overall investment required.

- Same expiration date: Ensure both options expire at the same time to create a spread.

Best Time to Use This Strategy

The best time to use a Bull Call Spread is when you anticipate a moderate rise in the price of the underlying asset. It’s not suitable for markets where a significant price surge or drop is expected.

Advantages

- Defined Risk: The maximum loss is limited to the net premium paid for the spread.

- Lower Cost: Selling the higher strike call helps offset the cost of buying the lower strike call.

- Profit Potential: You can achieve profits up to the difference between the two strike prices minus the net premium paid.

Disadvantages

- Capped Profit: The maximum profit is limited by the higher strike call option sold.

- Cost of Spread: The initial cost of setting up the spread can reduce overall profitability.

- Time Decay: As options approach expiration, time decay can erode the value of the position.

4. Bear Put Spread Strategy

The Bear Put Spread is an options trading strategy used when an investor expects a moderate decline in the price of a security or asset. It involves buying put options at a higher strike price while simultaneously selling the same number of put options at a lower strike price, both with the same expiration date.

How to Use the Strategy

To implement a Bear Put Spread, follow these steps:

- Buy put options: Purchase put options at a higher strike price for the asset you believe will decline in value.

- Sell put options: Sell an equal number of put options at a lower strike price to offset part of the cost.

- Same expiration date: Ensure both the bought and sold options expire at the same time.

Best Time to Use This Strategy

The Bear Put Spread is best utilized when you anticipate a moderate decrease in the underlying asset’s price and wish to minimize the cost of the trade.

Advantages

- Risk Management: The strategy limits the maximum loss to the net premium paid for the spread.

- Cost-Effective: Selling the lower strike put helps offset the cost of buying the higher strike put.

- Defined Profit and Loss: Both the potential profit and loss are limited and known in advance.

Disadvantages

- Capped Gains: The profit potential is limited to the difference between the two strike prices minus the net premium paid.

- Premium Costs: The cost of buying the higher strike put can be significant, reducing overall profitability.

- Requires Precision: The strategy requires accurate predictions about the price movement and timing.

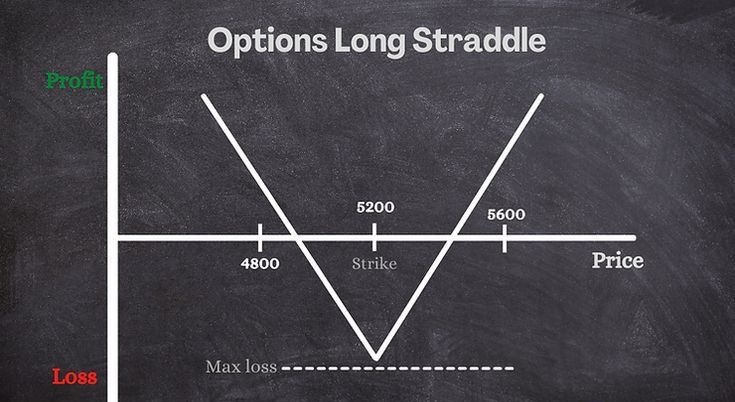

5. Long Straddle Strategy

The Long Straddle is a neutral options trading strategy that involves purchasing both a call and a put option at the same strike price and expiration date. This approach is designed to profit from significant price movements in either direction of the underlying asset.

How to Use the Strategy

To implement a Long Straddle, you should:

- Buy a call option: This gives you the right to buy the underlying asset at the strike price.

- Buy a put option: This gives you the right to sell the underlying asset at the strike price.

- Same strike and expiration: Ensure both options have the same strike price and expire at the same time.

Best Time to Use This Strategy

A Long Straddle is best used when you expect a significant move in the underlying asset’s price but are uncertain about the direction. It’s particularly useful around events like earnings reports or major economic announcements that can cause volatility.

Advantages

- Unlimited Profit Potential: Profits can be substantial if the asset moves significantly in either direction.

- Limited Risk: The maximum loss is limited to the premiums paid for the options.

- No Directional Bias: It allows you to profit from volatility without predicting the direction of the move.

Disadvantages

- High Cost: The combined premiums for buying both options can be expensive.

- Time Decay: Options lose value as expiration approaches, which can erode potential profits.

- Volatility Requirement: The strategy requires a significant price change to be profitable

6. Long Strangle Strategy

The Long Strangle is a versatile options trading strategy that involves purchasing an out-of-the-money (OTM) call and an OTM put on the same underlying asset with the same expiration date. This strategy is designed to profit from significant price movements in either direction.

How to Use the Strategy

To execute a Long Strangle, you should:

- Buy an OTM call option: This gives you the right to buy the asset at a strike price above the current price.

- Buy an OTM put option: This gives you the right to sell the asset at a strike price below the current price.

- Same expiration date: Ensure both options expire at the same time to create a strangle.

Best Time to Use This Strategy

A Long Strangle is best utilized when you expect a significant move in the underlying asset’s price but are uncertain about the direction. It’s particularly useful around events that can cause volatility, such as earnings reports or major economic announcements.

Advantages

- Unlimited Profit Potential: Profits can be substantial if the asset moves significantly in either direction.

- Limited Risk: The maximum loss is limited to the premiums paid for the options.

- Flexibility: It allows you to benefit from volatility without a directional bias.

Disadvantages

- Higher Cost: The combined premiums for both options can be expensive.

- Time Decay: Options lose value as expiration approaches, which can erode potential profits.

- Volatility Requirement: The strategy requires a significant price change to be profitable

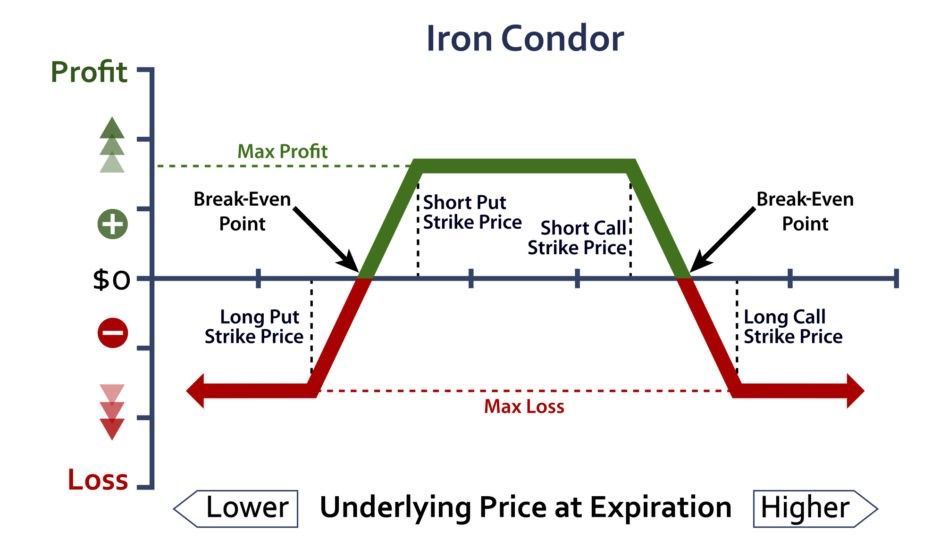

7. Iron Condor Strategy

The Iron Condor is a sophisticated options trading strategy that capitalizes on a stock remaining within a specific price range. It combines a Bull Put Spread and a Bear Call Spread, essentially selling a put and a call spread on the same asset with the same expiration date.

How to Use the Strategy

To implement an Iron Condor, you should:

- Sell an OTM put: Choose a put option with a strike price below the current stock price.

- Buy an OTM put: Select a put option with a lower strike price than the one sold.

- Sell an OTM call: Choose a call option with a strike price above the current stock price.

- Buy an OTM call: Select a call option with a higher strike price than the one sold.

- Same expiration date: Ensure all options expire at the same time.

Best Time to Use This Strategy

An Iron Condor is best utilized when you expect the stock to remain within a specified price range, especially in low volatility environments.

Advantages

- High Probability of Profit: Can earn a premium on both sides of the market.

- Defined Risk: The maximum loss is known at the time of trade entry.

- No Directional Bias: Profits as long as the stock stays within the price range.

- Flexibility: Offers the ability to adjust the trade if the market moves against it.

Disadvantages

- Limited Profit: Profit potential is capped at the net premium received.

- Complexity: Requires a good understanding of options trading.

- Risk of Loss: While the risk is defined, losses can occur if the stock moves out of the price range.

- Management: Needs active monitoring and potential adjustments

8. Butterfly Spread Strategy

The Butterfly Spread is an options trading strategy that combines features of both bull and bear spreads. It’s a market-neutral strategy that involves using four options with three different strike prices. The goal is to profit from low volatility in the underlying asset.

How to Use the Strategy

To execute a Butterfly Spread, you should:

- Select three strike prices: Choose an at-the-money (ATM) strike price, a lower strike price, and a higher strike price.

- Buy one ITM or OTM option: Purchase a call/put option at the lower/higher strike price.

- Sell two ATM options: Write two call/put options at the ATM strike price.

- Buy one OTM or ITM option: Purchase a call/put option at the higher/lower strike price.

- Ensure equal distance: The higher and lower strike prices should be equidistant from the ATM strike price.

Best Time to Use This Strategy

The Butterfly Spread works best in a non-directional market where security prices are less volatile. Ideally, the underlying asset price should equal the middle strike price as the options near expiration.

Advantages

- Fixed Risk: Comes with a limited and known risk.

- Capped Profit: While profits are limited, they are also known and can be maximized if the underlying asset’s price remains stable.

- Market Neutral: Profits from low volatility and does not require a directional bet on the asset’s price movement.

Disadvantages

- Limited Profit: The profit potential is capped at the net premium received.

- Complexity: Involves managing multiple options and strike prices.

- Costs: Premiums paid for buying options can reduce overall profitability.

Disclaimer:

The information provided in this blog is for educational and informational purposes only. It is not intended as financial advice or a recommendation to engage in any specific trading strategy. Trading options involves risks, and individuals should carefully consider their financial situation and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results. The author and publisher of this blog are not liable for any losses or damages incurred from the use of the information provided.